Key Takeaways

Consider a fractional CFO if you need a forward-thinking strategist or want to identify developing trends and opportunities to bolster growth. Compare the roles here >

Fractional controllers are perfect if you need a tactical teammate to execute accounting tasks so your company is primed for growth.

Choosing whether to onboard a fractional CFO or controller depends on your business’s unique needs and future goals. Find what one is right for you >

When your budget can’t justify adding a full-time employee to your team, hiring a fractional CFO or fractional controller is a cost-effective solution to get expert financial guidance for your company.

Fractional CFOs and controllers are rising in popularity amongst SMBs, startups, and nonprofits. Studies show a 46% increase in interim CFOs and a 114% increase in interim finance controllers since 2022. Companies preparing for projects like Enterprise Resource Planning (ERP) implementation, mergers and acquisitions, fundraising, or regulatory compliance are rapidly turning to unbiased and high-level financial professionals for short-term guidance.

But how do you know which role will make the biggest impact on your unique situation? In this guide, you’ll learn the big differences and benefits between CFOs and controllers so you can determine the most effective solution for your growing organization’s goals.

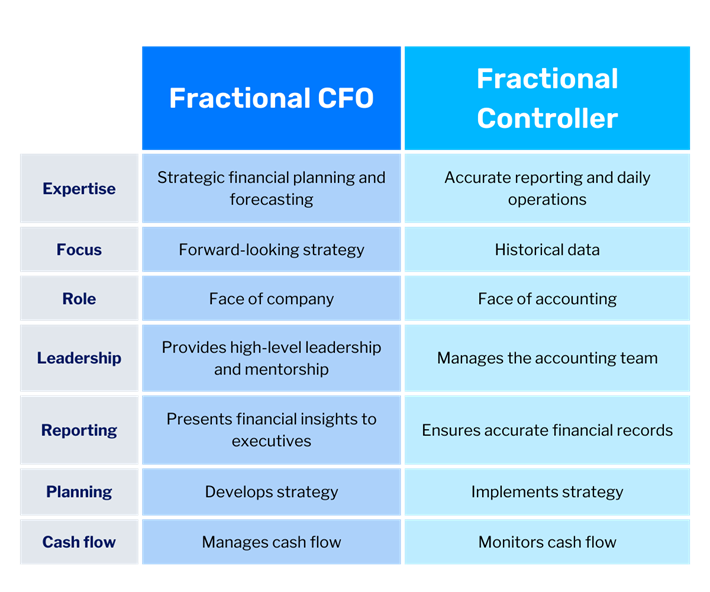

Understanding the Roles: Fractional CFO vs. Fractional Controller

First and foremost, fractional does not necessarily mean offshore. The right fit should be an experienced, US-based finance professional, who has a background in strategic decision-making, is knowledgeable about finance technology, and closely follows market trends.

The best fractional CFOs and controllers work with you to scale and personalize solutions to fit your company’s needs. Plus, they’ll meet with you and your stakeholders as needed—whether it’s monthly, weekly, or even daily during critical events—and actively contribute as a seamless part of your team.

Fractional CFOs Strategically Drive Your Business Forward

So, what is a fractional CFO? They’re forward-looking, experienced, executive-level financial professionals who strategize for a business’s long-term goals, create a roadmap for business growth, and confidently guide the company forward. Typically, they have a bachelor’s degree in finance or accounting and have earned their MBA.

Exceptional CFOs collaborate with every team, think big-picture, problem-solve roadblocks, and ask important questions. These skilled leaders can take charge of the following:

- Strategic financial planning and analysis

- Leading and managing fundraising and investor relations

- Overseeing risk management and compliance

- Forecasting high-level financial reports

- Supporting your company with mergers and acquisitions

- Participating or leading board meetings

When is Partnering With a Fractional CFO Most Effective?

The average full-time CFO’s salary at an SMB is $237,983. If your business needs strategic financial planning or risk management but doesn’t have the budget for a full-time CFO, partnering with a fractional CFO could be the next-best option.

Here are a few scenarios where your company could benefit from working with a fractional CFO:

- You need an expert to assist with scaling and managing rapid business growth.

- You want access to a broader network of financial professionals and resources to help support your small but mighty team.

- Your business needs a face of the company who will boost its credibility with investors and stakeholders.

- Your early-stage startup is seeking fundraising and investment support.

- You need a financial voice on your key management team

- You need a well-developed cash flow model

Consider a fractional CFO if you need a forward-thinking strategist or want to identify developing trends and opportunities to bolster growth.

Now, let’s dive into the specifics of controllers, who manage day-to-day accounting tasks.

Fractional Controllers Manage Your Finance Team

Controllers take the CFO’s monetary goals and execute them. They’re detail-oriented accounting experts who review a business’s historical financial data, manage revenue and cash, generate financial statements, and report on finance analytics.

Controllers typically have a bachelor’s in accounting and a CPA, so they excel at:

- Managing your company’s day-to-day accounting operations

- Overseeing your accounts payable/receivable, payroll, and general ledger

- Ensuring your business has accurate financial statements and reporting

- Managing and monitoring cash flow at your company

- Producing reports and delivering important data points

When is Partnering With a Controller Most Effective?

As 55% of accountants consider leaving their jobs due to increased stress and burnout, teams are hurrying to fill gaps and prevent errors. But even if your company isn’t being affected by the accountant shortage, an organized and professional fractional controller can support your financial goals by:

- Optimizing financial reporting systems and processes to improve operational efficiencies and decrease inaccuracies

- Defining the company’s financial KPIs and ROI

- Creating investor-ready documentation

- Preparing financial statements in accordance with GAAP (Generally Accepted Accounting Principles)

- Preparing for business audits or regulatory compliance reviews

Fractional controllers are perfect if you need a tactical teammate to execute accounting tasks so your company is primed for growth.

Decision-Making Criteria for Choosing the Right Accounting Service

Choosing whether to onboard a fractional CFO or controller is nuanced because it largely depends on your business’s unique needs and future goals.

To help with the decision-making process, we’ve created a comparison chart and developed specific questions that will help you assess whether a strategic, forward-looking expert or a detailed, operationally-focused professional would make the biggest impact.

- Confirm your company’s budget and level of need for adding a financial professional.

- Can we afford to hire and train a full-time executive-level financial professional, or would a part-time, fractional solution better fit our budget?

- Examine your company’s current financial team structure and identify the gaps.

- Do we need immediate enhancements in the accuracy and reliability of our financial reporting?

- Would the gaps in our financial team be resolved by adding another expert with the bandwidth to execute tasks or by adding an experienced financial professional to provide strategic insight and direction to shape our financial future?

- Review your business’s current financial challenges and pain points.

- Are we looking for guidance on how to finance sustainable future growth and develop long-term financial strategies?

- Do we need support to implement new financial technology or upgrade our software?

- Are we preparing for significant growth, fundraising, mergers, acquisitions, or other major transactions?

- Does our company know which key performance indicators (KPIs) and financial metrics need to be monitored to drive our business forward?

- Are we trying to gain a clear understanding of our KPIs and data, and curate accurate reports that reveal our financial history?

- Determine if your company needs strategic or operational financial assistance or both.

- Would high-level financial strategy and planning or improvements in our day-to-day financial operations make the biggest impact?

- Do we need short-term tactical support during an upcoming project that will take up most of our team’s bandwidth for several months, such as an ERP implementation?

You may determine your company needs support from both professionals. Or you might discover that it would be most impactful to work with a fractional controller first, then bring on a CFO, or the reverse.

Get Expert Financial Guidance

If you’re ready to partner with a fractional CFO or controller (or both), reach out to SC&H.

SC&H is a national consulting firm with 30+ years of experience optimizing financial processes and driving strategic growth for startups, nonprofits, and SMBs. We design every engagement to become part of your team, not the other way around, which means we adapt to your culture and processes while introducing modern approaches.

Our goal is for your team to spend less time trying to learn new systems and more time growing your business.