Published by The Daily Record, September, 29,2024

The Federal Reserve’s Main Street Lending Program (MSLP) was once a critical program that helped many businesses survive during the pandemic. Four years later, with fast-approaching maturity dates, many businesses are at risk of default.

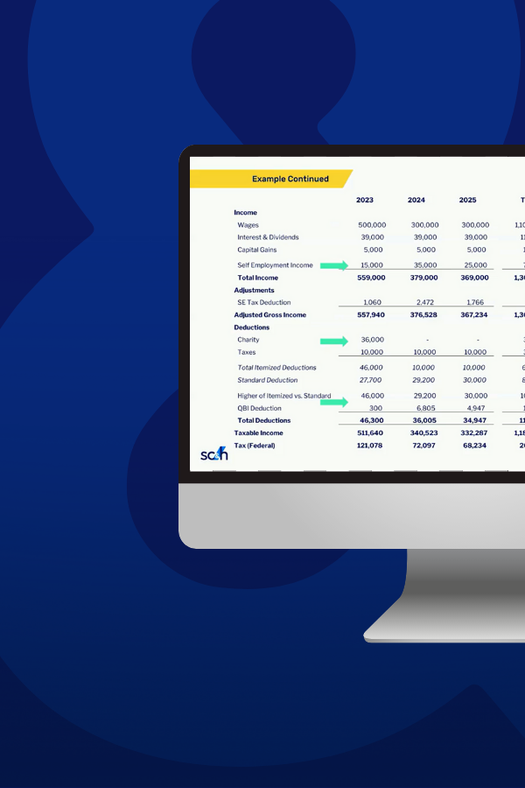

As of August 2024, the Federal Reserve reported just over $1 billion in MSLP loan losses. The structure of the loan and payment schedule, combined with rising interest rates, led to a significant increase in defaults in 2023 and 2024. Years three and four of the program were particularly challenging for borrowers:

- Borrowers had to begin making amortization payments on top of ongoing interest obligations

- Interest rates had risen significantly since the loans were issued leading to much higher payments than anticipated

Year five of the program, 2025 for most borrowers, will prove to be the most challenging, with the remaining 70% of principal coming due. If your business is struggling with MSLP loan payments, time is running out to find a solution. The MSLP expires on December 31, 2026, meaning, if you are able to restructure your loan, you must have all agreed-upon payments paid by that date.

Read the full article to fully understand the program’s complexities and limitations, the challenges borrowers face as interest rates rise and loan maturity dates draw near, and the negotiation opportunities available for distressed situations.