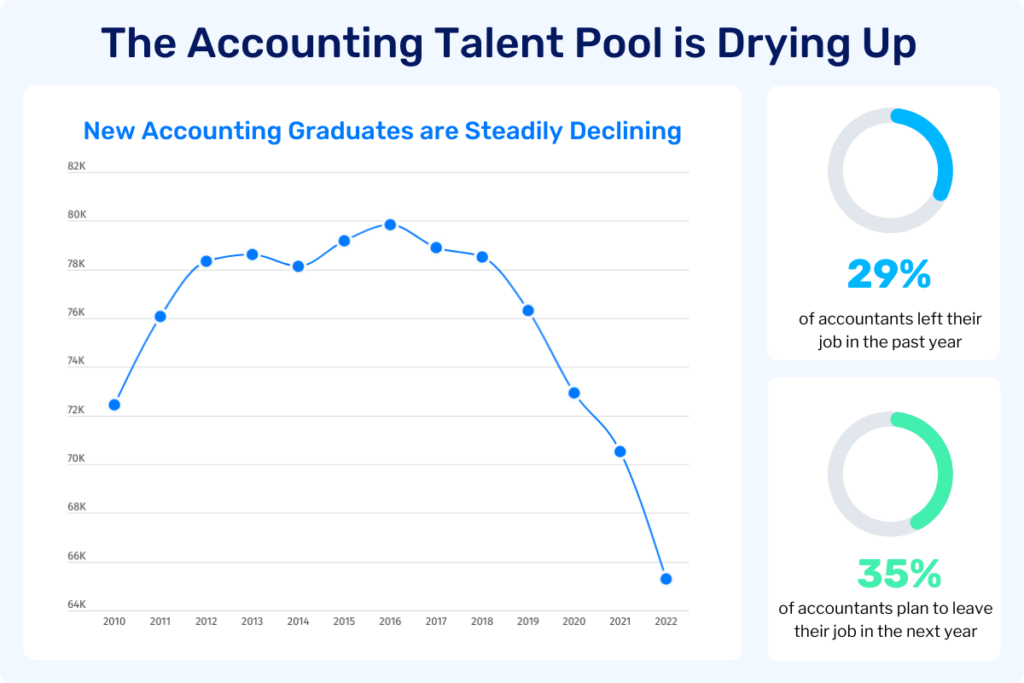

The accounting talent pool is drying up, and there’s no sign of relief in the immediate future. Recent trends show that accountants are leaving the industry in droves, while the number of new accountants entering the field has steadily declined since 2019.

As a result, businesses are struggling to find qualified candidates. And their teams are feeling the impact. 55% of accountants are considering leaving their jobs due to increased stress and burnout, a direct consequence of the talent shortage and increased workload.

So, what’s the fix? More and more businesses are turning to fractional services—the new buzzword for high-level outsourced professionals—to ease the pain of the accountant exodus. Let’s dig into how the shortage is impacting businesses, and why hiring an outsourced accounting team might be the cure.

How The Accountant Shortage Is Impacting Businesses

While new accountants are on the decline, many businesses were sheltered from the impact due to the stable older generation of finance professionals. But that protection is waning. 75% of CPAs reached retirement age in 2020, with few newbies to replace them, resulting in many small businesses taking a financial hit.

A shrinking pool of accounting and finance professionals at all skill levels puts a significant strain on small businesses where resources are already scarce. Finance leaders are experiencing several pain points, including:

- Reduced employee retention: Existing accounting staff are experiencing burnout at a staggering rate, often taking on excessive workloads to fill the gaps. This leads to increased turnover, which significantly hinders stability and productivity.

- Increase in accounting errors: With accounting resources stretched thin, the risk of errors and delays increases. Studies show a 30% increase in companies citing insufficient staff as the reason for financial statement errors over the past four years.

- Inefficient financial processes and systems: Finance teams are often struggling to keep their heads above water, leaving little bandwidth to innovate and implement modern technologies or processes.

- Insufficient time for strategic financial initiatives: A shortage of accountants can hinder a company’s ability to make strategic decisions, plan budgets, and secure funding. 60% of finance leaders cite the talent shortage as a significant barrier to achieving their strategic growth priorities.

- Increased Costs: Salaries for accounting roles are rising due to the demand-supply mismatch, and businesses are spending more on recruitment and improved benefits packages to attract and retain qualified candidates.

Leveraging the power of fractional accounting resources can address the immediate challenges of the talent shortage while saving money, improving processes, and positioning your business for long-term success.

The New Era of Fractional Accounting

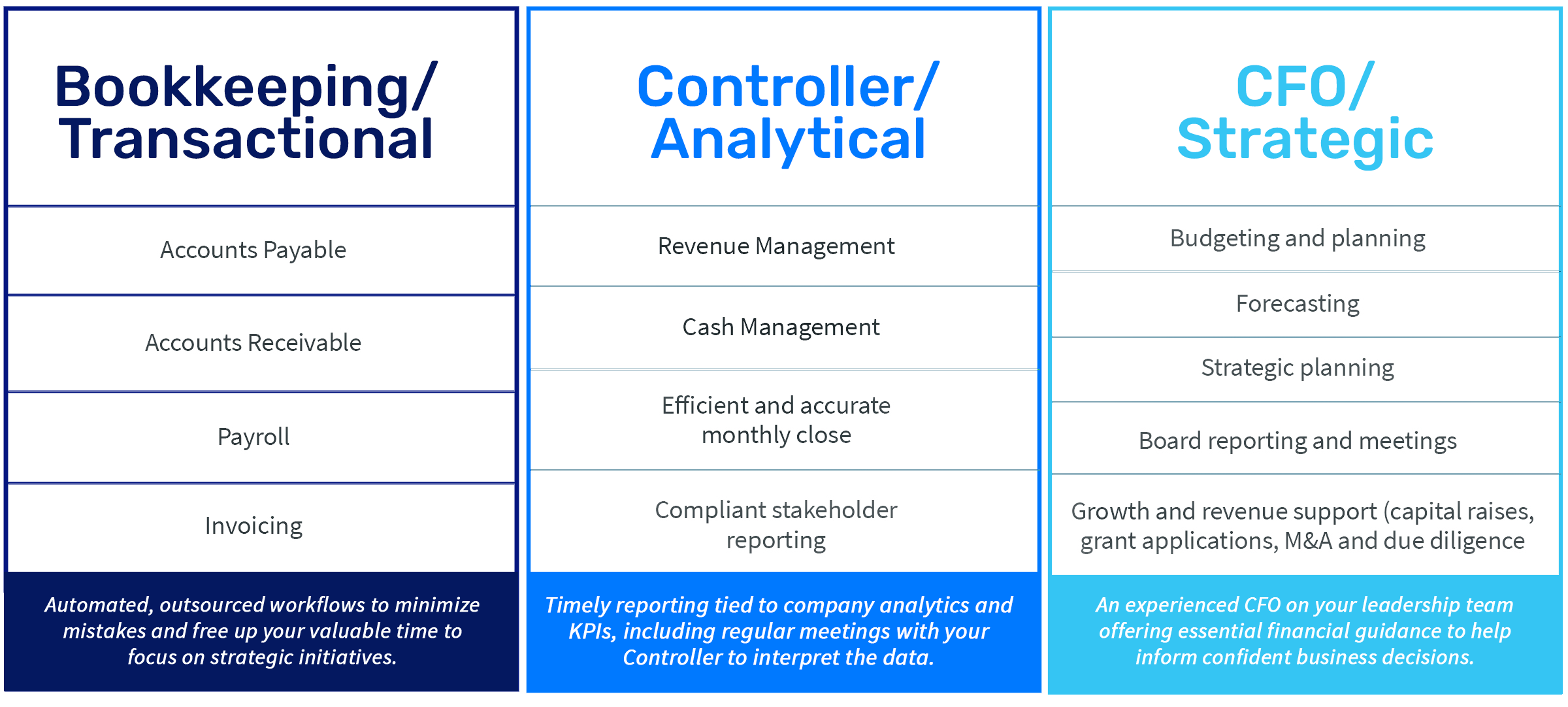

Outsourcing often comes with negative stigmas of offshore contractors, one-size-fits-all templates, and poor service. The new generation of high-quality, US-based fractional services is changing that stigma quickly. More and more businesses are utilizing outsourced partners to fill critical gaps, eliminate pain points, and integrate seamlessly with existing finance teams. Services range from basic bookkeeping to CFO-level leadership and everything in between.

Amidst the new era of high-quality fractional partners, some traditional outsourcing firms still rely on cheap offshore resources and inexperienced staff to close the books. One way to tell the difference between the good and the bad? Check the experience level of the staff that leads their engagements. The best partners pair an experienced controller or finance leader with every client to ensure quality service and strategic advisory (for example, SC&H appoints a controller or CFO advisor for every client, regardless of the service provided).

Outsourced Accounting: An Instant Pain Reliever for Finance Leaders

Whether serving as your finance function or executing on a specific need, the right-fit fractional accounting partner collaborates with your in-house team to solve the following challenges:

| Pain Point | How Outsourced Accounting Can Help |

|---|---|

| Reduced employee retention | Outsourcing alleviates the burden on in-house accounting staff and reduces burnout. Businesses that utilize outsourced accounting services report a 40% reduction in employee turnover within their internal accounting departments. |

| Increase in accounting errors | An outsourced team can fill bandwidth gaps quickly to ensure timely and accurate financial reporting. This means less errors, faster processes, and better quality. |

| Inefficient financial processes and systems | An experienced fractional controller possesses the necessary experience to help you implement advanced software and technologies, transforming your processes for the better. And, unlike an in-house hire, these services can be scaled up or down based on your current needs without long-term commitments. |

| Insufficient time for strategic financial initiatives | A fractional team can fill critical gaps in your team at every level. They can provide high-level strategic expertise to develop a long-term plan, freeing up internal resources to focus on day-to-day operations. Or they can help streamline the core processes to get your team out of the weeds and into the driver’s seat. |

| Increased Costs | Outsourcing can reduce costs by up to 50% compared to in-house operations. Businesses can access high-level financial expertise without the expenses associated with full-time salaries, benefits, and overhead costs. |

Fractional controller and accounting resources can provide instant relief to fill bandwidth gaps, scaling to meet your needs at every skill level. Plus, an outsourced team of experts also brings more specialized expertise than one single in-house hire, without the hassle of traditional hiring processes.

“After working with SC&H’s outsourced team, I never want to go back to an in-house accountant. It’s so much better to have two or three people with specializations, especially considering how time- and resource-intensive our finance processes can be.”

Taylor Santiago | Vice President, MTM Trucking & Logistics

Explore the Case Study

Growing businesses in need of finance leadership may also require the support of a fractional CFO. While outsourced accountants manage core financial operations, a fractional CFO focuses on high-level strategy. They offer C-level expertise at a fraction of the cost of a full-time CFO.

How to Ensure A Successful Outsourced Accounting Partnership

While businesses increasingly turn to fractional services amid the talent shortage, it’s not all smooth sailing. Integrating an outsourced partner can come with growing pains, such as poor communication and lack of role definition. Here are a few tips to avoid potential pitfalls and integrate seamlessly:

- Define the scope of work clearly. Ensure that both parties have a clear understanding of what is included (and excluded) from the partner’s role, while understanding that the scope may evolve. We often discover partway through an engagement that a client requires more help and amend the scope as needed.

- Establish open communication channels. Set up regular meetings to discuss progress, address concerns, and share insights. A culture of openness and trust will facilitate more effective collaboration and problem-solving.

- Onboard them like a new team member. Provide them with a holistic view of your business so they fully understand your needs, and hold them to the same expectations that you would a full-time member of your team. A fractional team member should be equally invested in your success and contribute noticeable impact.

With a little extra work on the front end, you can reap the benefits of a lasting partnership that transforms your finance function for the better.

Ready to optimize your financial management? The SC&H accounting team offers strategic financial support, from fractional CFO advisory to a fully outsourced accounting function. Trusted by hundreds of nonprofits and SMBs, we provide on-demand expertise and flexible solutions to fit your growing needs. Reach out today to explore how we can help drive your business forward.