Nonprofit accounting processes are viewed through a lens of accountability instead of profitability, with funds reinvested back into the organization. Because of this, having an easy-to-use chart of accounts (COA) in place is crucial to a not-for-profit’s accounting approach.

In this article, we’ll delve into the unique challenges nonprofits face with accounting and share six tips for creating and keeping an efficient chart of accounts.

Why Simple COAs are Necessary for Nonprofits

A nonprofit’s COA acts as a comprehensive filing cabinet. It’s the framework for storing all the organization’s financial information and transactions. It also houses details about checking accounts, investments, payroll, and utilities, impacting everything from data entry to financial reporting.

Without an organized chart of accounts, it’s extremely difficult to create impactful financial reports, develop internal controls, provide stakeholder reporting, and make strategic decisions about the future.

But like most aspects of business, nonprofits have a unique set of challenges.

Top COA Challenges for Nonprofits

- Cash management for a nonprofit can be tricky

Unlike for-profit organizations, nonprofits can’t rely on goods and services with net 30-day payment terms. Instead, they depend on foundations, governments, and donors, which all have their own payment and disbursement schedules. - Historical data isn’t consistent

Planning future goals is hard to do when historical data is inconsistent and each previous year has been different. New revenue streams must be tracked with a consistent system and old accounts need to be identified and closed out so data can be clean and reliable. - Nonprofits must share accurate financial reports with stakeholders

Organizations are expected to report to a board of directors, donors, executives, grantors, and staff, and each has unique requirements. - Legacy systems make real-time reporting difficult

Manually extracting data and stitching it together from multiple sources makes live analysis impossible. Plus, older systems tend to create COAs with extensive strings of account numbers, which is unmanageable for small teams. This causes “drowning in details”. - Multiple dimensionality is necessary for nonprofit accounting systems

Every dollar that comes in and out of the organization must be tracked and should have the ability to be viewed in multiple dimensions, such as:- Funds

- Grants

- Programs

- Projects

- Locations

The solution to handling all these challenges is a simple, dynamic COA. So, how do you set up an easy-to-use reporting system that can provide real-time reporting?

How to Set Up a Chart of Accounts

Creating a well-structured COA is crucial for a nonprofit’s financial health, but knowing how to set one up can be overwhelming. Here are the key steps to get you started.

1. Define Your Organization’s Structure

Begin by identifying your nonprofit’s key programs and departments. Break these down into core functions and sub-functions, and map out revenue streams like grants, donations, membership fees, and program fees. Categorize expenses into areas such as program, administrative, fundraising, and general operating costs.

Group your accounts into these main categories:

- Revenue Accounts: Look at your key revenue streams

- Expense Accounts: Break out your program services from your supporting services (G&A, Development, Fundraising)

- Other Revenue (Expenses): Interest, investment gains and losses, any non-operating

- Asset Accounts: Track tangible and intangible assets like property, equipment, and investments.

- Liability Accounts: Record obligations and debts such as accounts payable and loans.

- Equity Accounts: Reflect net assets and fund balances to showcase the financial standing of your nonprofit.

2. Choose a Coding System

Decide on a system that suits your organization’s size and complexity, such as a hierarchical or alphanumeric code. Assign unique codes to each account and stay consistent.

3. Create Account Titles

Use clear and concise titles. The titles must be easy to understand and reflect the nature of the transaction. Align with accounting standards, such as GAAP or FASB, to ensure accurate and stress-free financial reporting.

4. Consider Future Growth

Design your COA to accommodate future growth and new programs to save your team the hassle of going back and trying to make changes later. A flexible structure will help your nonprofit easily adapt to changing circumstances.

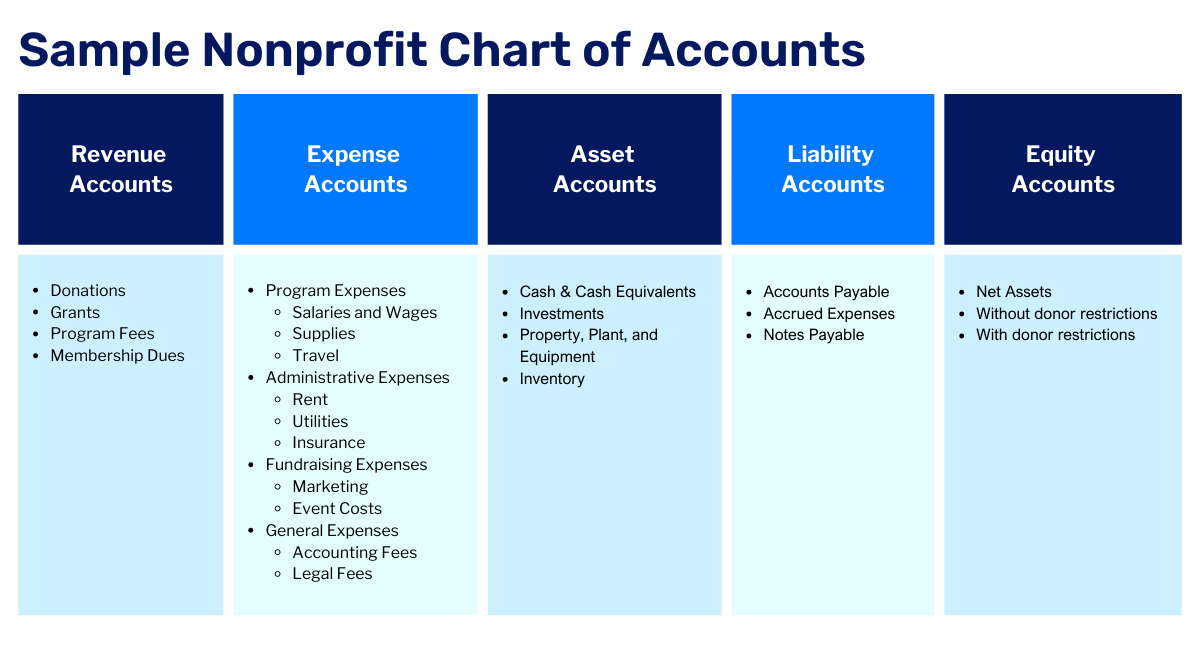

Example of a Standard Nonprofit COA

3 Tips to Make Your COA Efficient

As you set up your nonprofit’s COA, consider these strategies to maximize its efficiency.

1. Get Your COA Out of Outdated Systems (like Excel)!

Newer cloud software offers smoother processes, automation capabilities, and advanced out-of-the-box reporting that legacy systems can’t compete with.

We highly recommend Sage Intacct because it has helped many of our nonprofit finance teams minimize complexity, reduce the number of account codes, and save time. But other systems to consider are:

- NetSuite

- Workday

- Salesforce Nonprofit Cloud

2. Keep it Simple (And Compliant)

To track 10 projects, from six locations, with five departments each, you would need 300 account code combinations in a hard-coded chart of accounts. Talk about a headache!

Streamline your nonprofit’s COA by focusing on core natural accounts and adding dimensions, like location, department, and project. This approach sets the organization up to easily pull rich, contextual data without creating a complex, manual process.

Quick Tip:

Conduct an audit of your expense accounts and note if there are similar and separate accounts that could be combined. For example, instead of having separate accounts for “Office Supplies,” “Printing Costs,” and “Postage,” you could combine them into an “Office Expenses” account.

Consolidating similar accounts reduces the number of accounts in your COA, making tracking and analyzing your financial data easier. Plus, it ensures compliance with accounting standards like GAAP and FASB.

3. Build Donor Trust Through Transparency

Nonprofits must tell donors a compelling story about their mission and impact. Set up role-based dashboards with custom components, like reports, graphs, and communication feeds, that fit the needs of specific users.

Remember to highlight the outcome and impact of your nonprofit’s efforts in real time so reports show the human side of the mission.

Get Accounting Support for Your Organization

We understand how nuanced accounting best practices are for nonprofits. If you need support setting up your COA, snag a free 30-minute consultation with our team. We’d love to learn about your mission, understand your accounting pain points, and brainstorm solutions.