Authored by: Sarah Sedlak | VP of Business Development

Working on mission-driven initiatives with a happy team is every nonprofit’s dream.

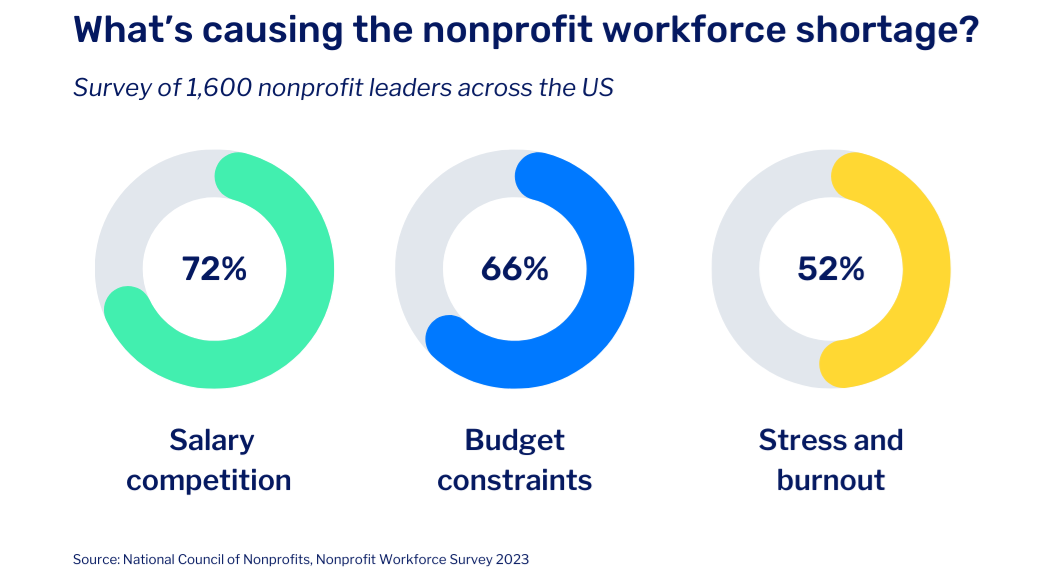

The reality is leaders reported higher-than-typical staff departures over the last year–55% attributed this to the inability to offer competitive pay or lost funding, and 29% pointed to staff stress and burnout as the culprit.

Trying to juggle a growing demand for transparency and compliance with burned-out, underpaid employees can feel like a never-ending nightmare, but there is a way to break the cycle!

We talked with our HR, IT, and accounting experts to compile three actionable strategies that your nonprofit can use to strengthen and streamline your operations–and no, they’re not finding a secret stash of gold in your strapped budget. Keep reading for our top tips on how to retain your team, focus them on their highest-value activities, and drive your mission forward!

Top HR Strategy: Beat the Turnover Trap

High turnover is a serious issue for nonprofit leaders. It’s no surprise why there is such high turnover, considering nearly a third of NFP staff quit due to stress and burnout in the past year. These employees are often doing the work of multiple people without being paid accordingly, which leads to low morale and dissatisfaction.

Making matters worse, the cost of replacing a departed employee is equal to one-third of their annual earnings when you factor in recruiting fees, temporary workers, and lost productivity. Securing funds to pay good employees a competitive salary is just one piece of the retention puzzle, though.

Our HR experts have some advice to reduce turnover and avoid a single point of failure: Only hire for what you need, then use fractional resources to fill in the gaps.

Consider Task-Based Hiring

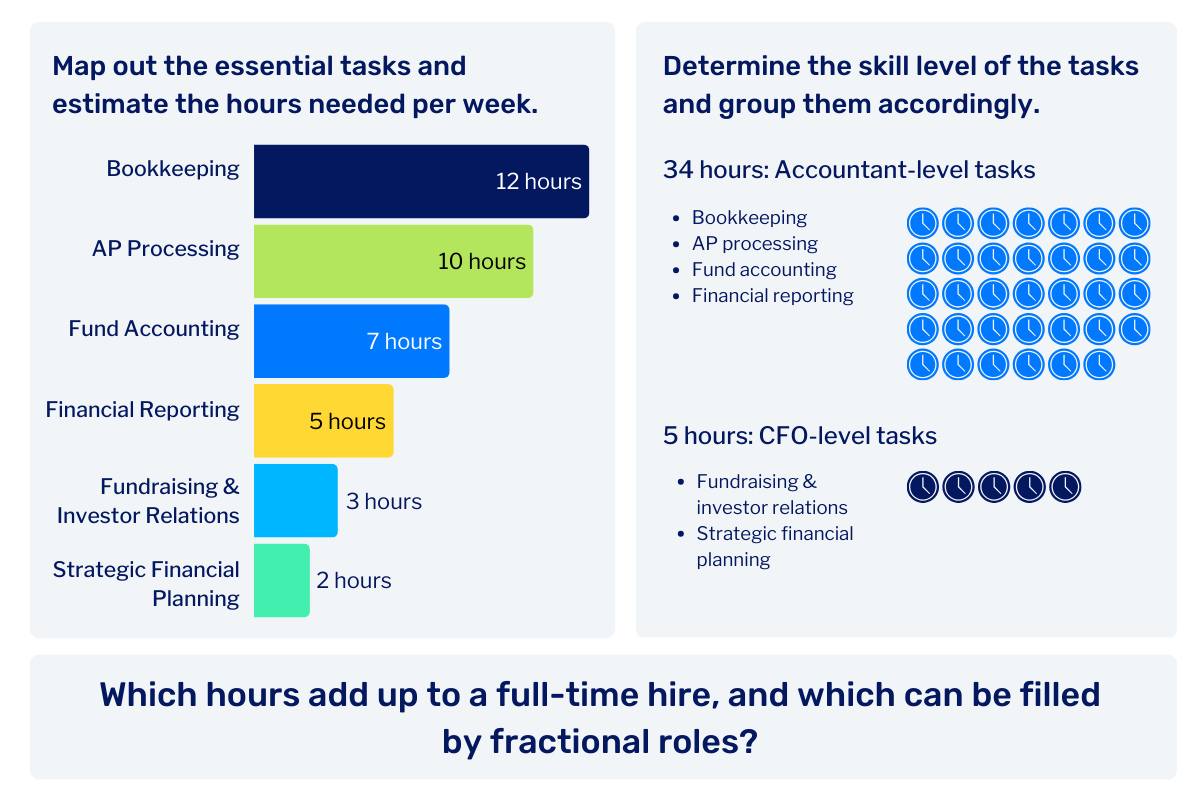

Hiring based on need means you take a high-level look at your operations and decide what full-time roles are necessary versus what tasks could be filled by fractional resources. To do this, map out what roles and tasks are essential and assign a time estimate to each.

For example, you might find that you need:

- 10 hours a week: accounts payable processing

- 12 hours a week: bookkeeping

- 5 hours a week: financial reporting

- 7 hours a week: fund accounting

- 3 hours a week: fundraising & investor relations

- 2 hours a week: strategic financial planning

Finding a single person to fill all of those roles is nearly impossible. And if you did hire someone experienced enough to take on everything, this person will become overworked, frustrated, and resign–then you’re back to square one.

Instead, take a more analytical approach. With the example above, 34 hours are devoted to tasks at the controller or accountant level, while 5 hours are dedicated to CFO-level tasks. That means you don’t need to pay a full-time CFO! You could fill a full-time senior accountant or controller role, and fill in the gaps with a fractional CFO at 20 hours per month.

The support of a few fractional experts–like a fractional CFO, an outsourced accounting team, or a co-managed IT partner–can help you:

- Conserve your budget by eliminating the cost of benefits and paid time off

- Competitively compensate full-time employees with saved money

- Work with experts who are really good at what they do

- Prevent employee burnout by reducing the workload on each person

One more tip: If you need to fill multiple roles, managing several different contractors can be a pain. Look for a firm that offers a one-stop-shop of fractional nonprofit experts across multiple roles—finance, operations, technology, and HR—to reduce the admin headache!

Top Technology Strategy: Automate Manual Tasks

We regularly hear how nonprofits are dealing with archaic technology and time-consuming, manual processes. As leaders know, these outdated practices often contribute to employee burnout, but perhaps more concerning are the cyber security and human error risks.

Older legacy systems quickly become a serious cyber security risk when they are no longer updated and supported. Not to mention, they usually don’t integrate with other systems, requiring manual processes that increase the risk of human error. You can’t afford to make costly mistakes because your legacy CRM requires your team to enter a grant fund in two systems—and the number was entered incorrectly in one or both systems. Instead, you can automate pieces of your process to improve efficiency and mitigate risk.

In a perfect world, your nonprofit would be able to enact all the latest technology trends, but our technology experts recommend starting with streamlining manual processes where you can.

Identify Everyday Processes to Automate

When you have to do more with less, automation is truly a lifesaver. Here are a few ways you can bridge the technology gap:

- Beginners should try Robotic Process Automation (RPA) for an easy, cost-effective way to automate simple manual tasks like data entry and invoice approvals.

- Next, try using RPA for more complex processes. RPA can collect data like AP transactions, donor statistics, or even campaign result data from multiple systems and consolidate it into an easy-to-read report

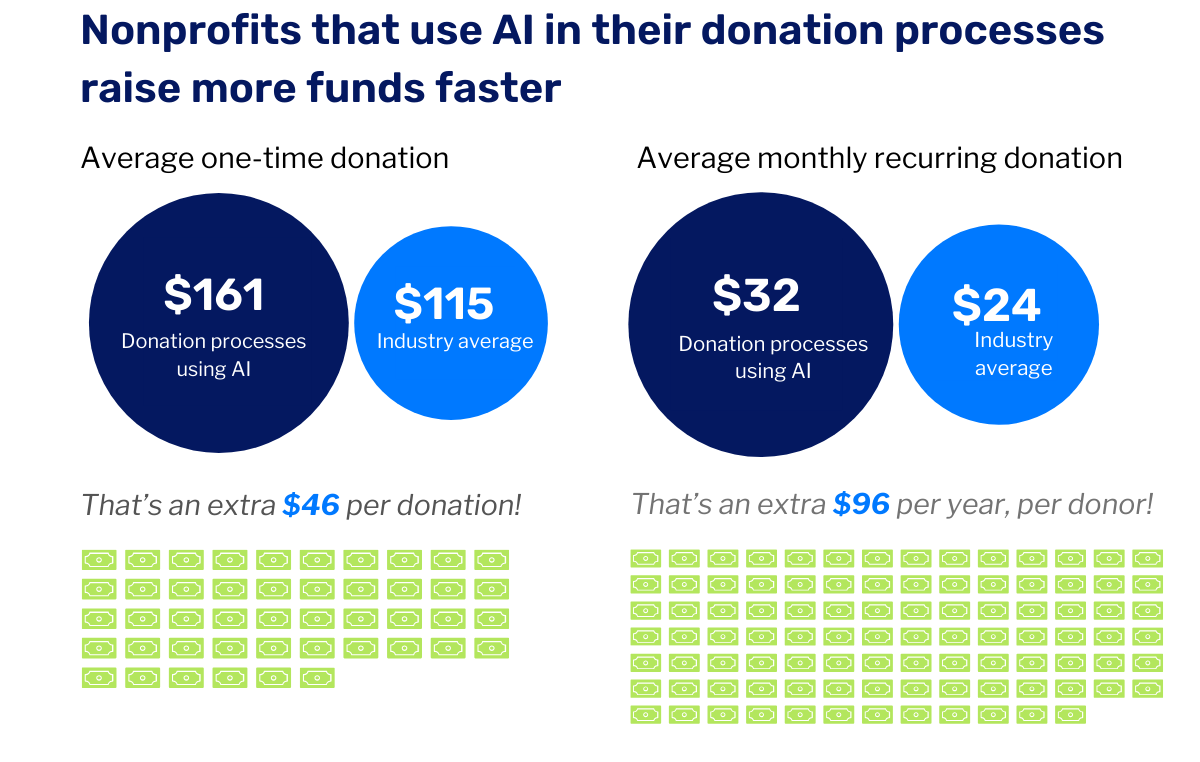

- For more experienced folks, unlock better fundraising opportunities with Machine Learning (ML). ML can analyze your database for trends and patterns, which can help your nonprofit hone in on hot audiences and channels. For example, did you know that digital donors are 48% more valuable than their offline counterparts?

Even automating just a few tasks can decrease human error risk and free up precious time so your team can focus on higher-level activities.

“As a nonprofit focused on providing resources to those overcoming addiction, our secret sauce is the quality care metrics of those treatment facilities. Investing in better technology and automation allowed our team to focus more on the core mission, versus performing a lot of menial tasks behind the scenes to make sure the data on our website is accurate and readily available for those we serve.” – Tim Kobosko, CIO, Shatterproof

Top Financial Strategy: Empower Your Team to Be Strategic

Lean staffing is particularly problematic for nonprofit financial practices. With the growing shortage of CPAs and insufficient bandwidth on the accounting team, many organizations are scrambling to keep up with ad hoc reporting requests.

Most nonprofits have multiple programs that are funded by several different grants, which makes reporting very complicated. Even a simple question like, “How much of Grant A is available for program budgets versus actual spending?” can be difficult to answer.

The team knows Grant A gave them $1,000,000, of which only 25% are unrestricted funds, but some of those funds have already been spent. Piecing together the trail of cash burn for each grant without clear details is like trying to find a needle in a haystack.

So, how do you get off the hamster wheel? Our finance team urges you to empower your team to make data-driven decisions. The best way to do this is by leveling up your reporting and using those insights to justify choices.

Create Insightful Reporting

Whether you’re using Sage Intacct, our favorite finance tool for nonprofits, or another program, reports should be able to help you answer these types of questions:

- What are our financial trends over the last 5 years?

- Are we too reliant on a single source of funding?

- What programs are most cost-effective?

- Are we in compliance with IRS, donor restrictions, and grant requirements?

- Are there areas where we can reduce inefficiencies or reallocate resources?

Without dynamic reporting, answering board members’ questions, preparing for audits, and making impactful decisions is extremely difficult.

Still Feel Like You’re Juggling Too Much?

If your team needs help executing these strategies, one solution is engaging the right amount of third-party support to help your nonprofit break the turnover cycle.

With SC&H, you’ll get a team of experienced, US-based fractional leaders across HR, technology, and finance for a fraction of the cost of an in-house hire. We’ll direct you towards the path of least resistance, helping you keep costs low while still getting you what you want and need. We’ve helped so many nonprofits–we know what works and what doesn’t.

We offer a flexible service model because we understand your nonprofit has unique needs and budget constraints. For example, if you only need help with a technology upgrade, our implementation team can manage the entire process, train your team, and then bow out and cheer you on from afar when it’s wrapped! Or, if you need long-term support, we have customizable retainer services to become an integral part of your team.

Schedule a 30-minute chat with me to talk through your challenges and understand how our outsourced services can support your team.