For many plan sponsors, managing a 401(k) or 403(b) plan can be an overwhelming task, but it doesn’t have to be. An increasing number of organizations, regardless of their size, are now using retirement plan committees to oversee their 401(k) and 403(b) plans.

When there was a downturn in the market a few years ago, it prompted hundreds of lawsuits filed by participants against their plans on the grounds of fiduciary negligence – and some even blamed the plan sponsor.

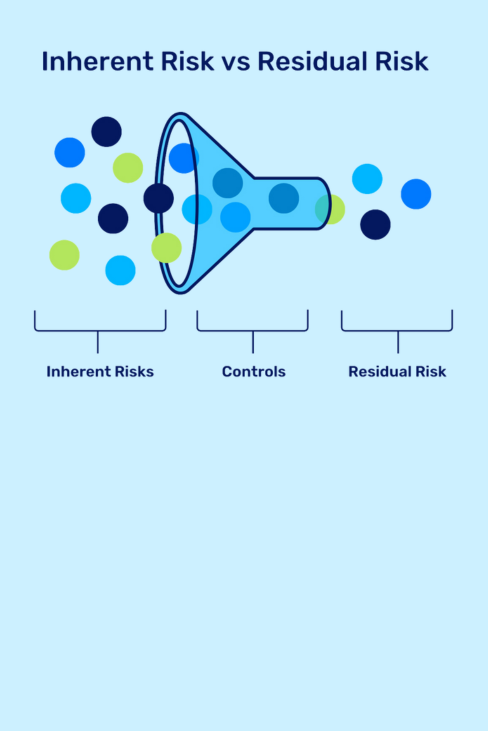

Consequently, many organizations have come to realize that a 401(k) or 403(b) plan committee that includes internal representatives, coupled with outside experts, can provide a depth of knowledge that can help mitigate lawsuits and other challenges.

As outlined by Retirement Management Services (RMS) in their blog, a plan must have at least one fiduciary named in the written plan, or through a process described in the plan, as having control over the plan’s operations. A plan’s fiduciaries will ordinarily include the trustee, investment advisers, all individuals exercising discretion in the administration of the plan, and all members of a plan’s administrative committee (if it has such a committee).

A retirement committee of members who have a thorough knowledge of the plan and its provisions enables the plan sponsor to demonstrate compliance with fiduciary requirements in two ways:

- It allows for documentation of all plan fiduciary decisions.

- It helps ensure there is a process in place for making decisions that are in the best interest of participants.

More than one individual is needed to understand all of the legal, investment, and administrative knowledge that is required when managing a 401(k) or 403(b) plan. To help reduce legal and fiduciary risk, it is a smart decision to take the time to put together a retirement plan committee.

To discover how to form a committee and what items should be discussed by its committee members, click here.

To learn more about SC&H’s Employee Benefit Plan audit capabilities, click here.