SC&H’s Key Takeaways

- The excess business loss limitation has been suspended for the 2018, 2019 and 2020 tax years

- Non-corporate taxpayers who have disallowed excess business losses from tax years 2018 or 2019 should consider amending these returns to free up the disallowed losses

- Taxpayers (excluding REITs) may now carryback NOLs up to 5 years

- NOLs may now offset up to 100% of taxable income, rather than the up to 80% of taxable income threshold put in place by the Tax Cuts and Jobs Act.

The recently signed Coronavirus Aid, Relief, and Economic Security Act (CARES Act, H.R. 748, the CARES Act) included an important adjustment to the Sec. 461(l) Excess Business Loss Limitation, which was only recently enacted by the signing of the Tax Cuts and Jobs Act of 2017 (TCJA). This new limitation on excess business losses was effective for noncorporate taxpayers for tax years beginning after Dec. 31, 2017 and was scheduled to sunset after December 31, 2025.

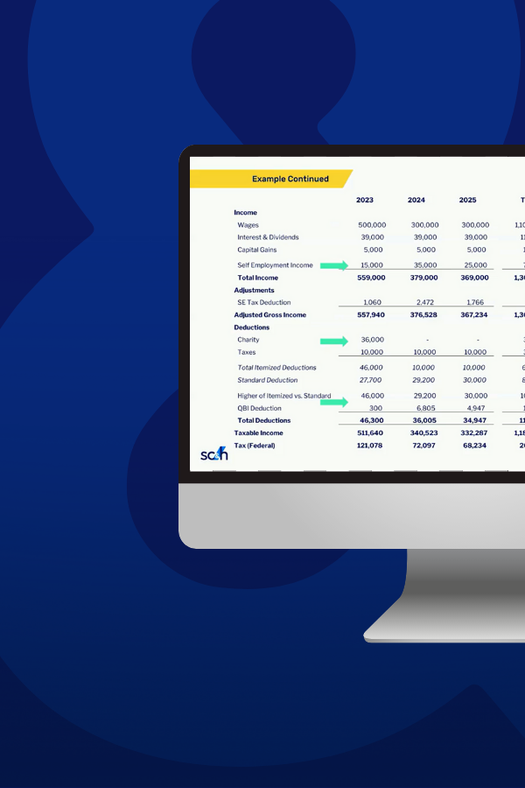

For tax years beginning on or after January 1, 2018, the new Sec. 461(l) disallowed business losses from pass-through entities and proprietorships in excess of $250,000 ($500,000 for married filing jointly) for noncorporate taxpayers. The limitation delayed the tax benefit of these excess losses so that losses over $250,000 or $500,000, depending on your filing status, could not offset nonbusiness income in the year the loss was recognized. Any excess business loss that was disallowed would be carried forward as a net operating loss (NOL). Form 461, Limitation on Business Losses outlined the ordering rules for these losses and tracked the availability of any disallowed deductions from prior years. Considering the taxpayer-friendly nature of the TCJA, this limitation inflicted a substantial burden on small-business owners.

Deferral of these excess business losses as NOLs proved problematic in the age of the TCJA. Previously, NOLs could offset up to 100% of taxable income. The TCJA included a provision which limited the eligibility of NOLs to offset up to 80% of taxable income. Under these new rules, any excess business losses disallowed and deferred to future years as an NOL would then be partially deferred for several more years before taxpayers could recognize the full benefit of the deferred excess business loss.

On March 27, 2020, President Trump signed the CARES Act in hopes of relieving economic pressure brought on by the growing COVID-19 pandemic. Included in the Act is a provision which suspends the Sec. 461(l) excess business loss limitation for tax years beginning on or after January 1, 2018 through December 31, 2020. Congress wisely suspended this limitation in order to provide relief to small business owners who incur losses in these years. Non-corporate taxpayers may temporarily be eligible to take full advantage of business losses previously limited under Sec. 461(l). Taxpayers who had business losses limited under 461(l) in 2018 or 2019 should consider filing amended returns to generate tax refunds.

Taxpayers (other than REITs) have also received additional benefits related to Net Operating Losses (NOLs.) The TCJA enabled NOLs to be carried forward indefinitely, beginning in tax year 2018. As previously mentioned, the TCJA also put into place a new rule that NOLs are only allowed to offset 80% of taxable income. The CARES Act changes these TCJA rules in two ways. First, NOLs are now allowed to be carried back up to five years, rather than the two-year rule previously in place. Second, taxpayers are now allowed to use NOLs to offset up to 100% of taxable income for tax years 2018, 2019, and 2020. These provisions should provide welcome relief and enable taxpayers to claim refunds for taxes paid in previous years.

Once Sec. 461(l) is back in force in 2021, there will be several changes enacted:

- Wage income (and related deductions) will not be considered business income, which will likely cause many more taxpayers to face limitations under 461(l) starting in 2021.

- Deductions for losses from the sale of capital assets will not be reflected in the 461(l) calculation – this would appear to be good news as losses from the sale of 1231 assets would not reduce business income for these purposes

- When computing business income under this Code Section, gains from the sale of capital assets will be limited to the lower of your overall capital gain or the net gain from the sale of IRC 1231 assets – which are assets used in a trade or business.