Authored by Angelo Poletis | Principal, Tax

On December 13, 2022, the IRS issued Revenue Procedure 2023-8 thus updating the procedures for taxpayers to comply with changes to Section 174—Amortization of Research and Experimental Expenditures. Taxpayers experiencing accounting method change are required to file Form 3115 to disclose the change in the method of accounting. With Rev. Proc. 2023-8, taxpayers are provided with guidance on how to obtain automatic consent to change the method of accounting needed to comply with the rule changes of Section 174, waiving the need for Form 3115.

New Tax Return Statement Requirement

For the first tax year after December 31, 2021, Form 3115 is not required. In lieu of the form, a statement needs to be attached to the return and must include:

- The name, address, and employer identification number (EIN) of the taxpayer

- The beginning and end dates of the tax year the method change is effective

- The designated automatic accounting change—Revenue Procedure 2023-18 lists “265” as the designated change number

- A description of the research and experimental expenditures incurred or paid in the tax year

- The amount of the R&E expenditures for the year of change

- A declaration saying the taxpayer has changed its method to do all the following:

- Capitalize expenditures

- Amortize expenditures over a 5-year period for domestic research (15-year period for non-US research)

- Use the mid-year convention

- State the cut-off method was used in accordance with TCJA

Normally, a duplicate copy of Form 3115 is sent to the IRS National Office. The new procedures also waive the need to send a duplicate copy to the National Office. In accordance with the TCJA, a change in a taxpayer’s method of accounting to the required Section 174 method for the 2022 tax year must be made only on a cut-off basis. Therefore, there is no adjustment under Section 481 for expenditures paid or incurred in years beginning before January 1, 2022.

A Brief History of Section 174

Prior to January 1, 2022, Section 174 treated research and experimental expenditures as deductible. This rule from 1954 allowed businesses a deduction for research costs in the year they were incurred and acted as an incentive for businesses to seek opportunities for innovation and advancement. The Tax Cuts and Jobs Act of 2017 however changed the treatment of that rule, requiring research and experimental expenditures to be capitalized in the year incurred or paid and amortized over a five-year period using a mid-year convention.

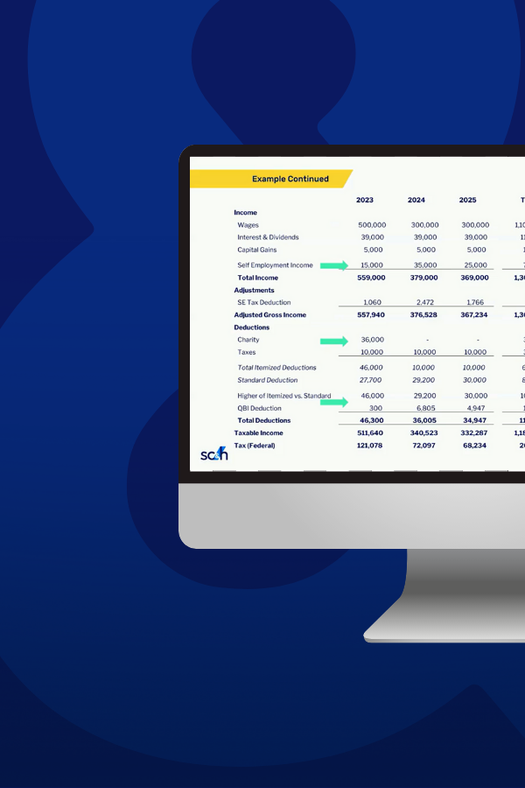

Expected Outcome on Filing Your Tax Return

The capitalization and amortization requirements for Section 174 create a delayed deduction and accelerate the payment of tax. However, with Rev. Proc. 2023-8, the IRS has taken steps to make compliance easier when filing your 2022 return.

If you have any questions about Revenue Procedure 2023-8 and the impact this could have on filing your tax return, please message our tax team and one of our professionals will contact you directly.