Authored by Judy Brown, CEPA, CPA, CFP® | Principal, SC&H Wealth

Key Takeaways

Not properly preparing for your exit can adversely impact your future financial security.

Accurately valuating your business can mean the success or failure of selling your business.

Decreasing the amount of risk in your business will increase the value when you go to sell.

Tax strategies should be carefully considered as each business and sale is different.

Your business is often your biggest asset. But without an intentional exit plan, it could become a financial risk. Let’s explore the strategies for a successful company exit.

How to Build an Exit Strategy for Your Business

Most business owners have 80-90% of their wealth tied up in their business, yet statistically, less than 30% of businesses that go to market actually sell. A well-executed exit plan not only helps you determine how and when to sell but can also significantly boost your business’s value, increase the sale price, and facilitate a smooth transition.

Before business owners sit down to plan, there are 4 essential components they need to understand:

- Define Your Goals Through Personal Financial Planning: How to assess and protect your wealth.

- Determine the Value of Your Business: How to use a business valuation to guide your exit strategy.

- Position Your Business to Maximize Value and Minimize Risk: How to enhance the appeal of your business, avoid unnecessary risk, and address legal and compliance issues.

- Increase Profits with Strategic Tax Planning Before You Sell: How to align the structure of the sale with your personal financial goals to minimize tax liability and maximize results.

You’ve worked hard to build your legacy. Start planning now for a smooth and profitable transition. Read on to learn how in detail.

#1: Define Your Goals Through Personal Financial Planning

A strong financial foundation is essential for a successful exit. Clearly define your personal goals first to chart a profitable path forward and time your exit perfectly.

- Build a Detailed Financial Plan: Unlike 75% of business owners, you can safeguard your future by carefully planning for life after business ownership. By addressing your cash flow, investments, estate planning, taxes, and charitable giving, you’ll create a robust framework for financial success now and for your next chapter. Equally important is risk management to protect against unforeseen events like death, divorce, or disability that could force a premature exit. A detailed financial plan will get you closer to achieving your post-business goals and guarantee financial security.

- Protect Your Wealth: Selling a business is a complex endeavor, often with uncertain outcomes. The harsh reality is that only 20-30% of businesses that go to market sell. Relying on only on a successful sale to fund your retirement or major life goals is a risky gamble. To protect your wealth and steer your future in the context of an exit strategy, we recommend the following:

- Diversify your assets by spreading your financial risk beyond your business

- Assess your wealth gap to understand difference between your desired retirement lifestyle and your current financial resources

- Increase your business’s worth over time by implementing informed strategies

Early planning gives you the flexibility to decide when to sell, not if. It empowers you to choose the best ownership transfer option and maximize the return on your life’s work.

#2: Determine the Value of Your Business

Before diving into a sale, business owners must determine the market value of their enterprises, not just the tax or asset value. An independent and objective business valuation evaluates your company’s financials, growth prospects, and risk factors to produce an accurate business appraisal report. This information will help you:

- Identify opportunities to improve the value of your business

- Attract interested buyers when you’re ready

- Negotiate a favorable deal aligned with your goals

- Navigate financing options to broaden the pool of potential buyers

- Resolve any complex legal disputes that might arise

A business valuation provides a clear picture of your company’s financial health and potential worth. You can then begin to prepare your business for sale.

#3 Position Your Business to Maximize Value and Minimize Risk

A business owner’s readiness to sell often outpaces the business’s preparedness. To command top dollar, a business must be optimized to appeal to buyers, and this takes time and careful planning. For the owner, this means minimizing risks, avoiding common pitfalls, and ensuring a dispute-free transition. Here’s what you should prioritize:

- Building a Strong Management Team: Potential buyers see owner dependence as a risk, so creating a capable, experienced management team makes your business more attractive to potential buyers. 75% of organizations with successful succession planning in place report higher employee retention rates. Investing in leadership development, documenting processes, and ensuring a smooth transition of responsibilities can contribute to the business’s ongoing success.

- Strengthening Customer and Vendor Relationships: Customer loyalty and strong vendor partnerships significantly boost a business’s sale price. Retaining existing customers is more cost-effective than acquiring new ones, and satisfied clients often become your best advocates. Meanwhile, collaborative and reliable vendor relationships streamline operations, reduce costs, and mitigate risks. This combined strength translates to a stable revenue stream, a solid brand reputation, and a competitive edge—all highly attractive to potential buyers.

- Managing Debt Effectively: Lower debt means higher profitability. Smart debt management reduces financial risk, protects your personal assets, and can help maximize the sale proceeds. Plus, potential buyers are more attracted to businesses with minimal debt burdens because it often means easier negotiations and an accelerated sales process.

- Addressing Legal and Compliance Issues: Overlooking legal or compliance issues, like contractual obligations, intellectual property, regulatory compliance, and pending lawsuits, can lead to costly delays or the collapse of a deal. A thorough legal review will help absolve the business of liabilities that might hinder a sale.

Potential buyers seek stability, profitability, and minimal risk, so reinforcing these areas will enhance the sale process and protect your interests.

#4 Increase Profits with Strategic Tax Planning Before You Sell

Understanding the tax implications of selling your business is necessary to boosting your financial return. By carefully considering your business structure, sales terms, and personal tax situation, you can implement tax-saving strategies to minimize tax liabilities and optimize your after-tax proceeds.

- Capital Gains Tax Planning: Capital gains tax can significantly erode the proceeds of a business sale. Strategies to minimize personal tax liabilities, such as utilizing available exemptions or structuring the sale in a way that optimizes tax outcomes can be effective ways to cut back on taxes owed.

- Succession Planning for Family-Owned Businesses: Family-owned businesses often involve intricate dynamics. By strategically implementing strategies like gradually gifting shares to family members, leveraging gift tax exclusions, or utilizing trusts for a tax-efficient transfer, you can achieve a seamless and tax-efficient transition to the next generation.

- Employee Stock Ownership Plans (ESOPs): An ESOP might be a powerful option that can offer substantial benefits to the business and its employees. With an ESOP, shareholders have the flexibility to sell either the entire business (100%), a majority percentage, or a minority percentage interest to the ESOP, enabling liquidity and ownership transition.

- Utilizing Tax Credits: Investigate available tax credits that can be applied during the exit process. Governments often provide incentives for specific types of business transitions, and staying informed about these opportunities can result in substantial savings.

Keep in mind that the method you choose to sell your business—whether through an investment banker, direct sale, or merger and acquisition (M&A) process—also significantly impacts your tax obligations. Each approach offers unique tax advantages and disadvantages. By carefully evaluating these factors, you can make informed, well-rounded decisions about your exit strategy.

The Role of a Certified Exit Planning Advisor (CEPA)

Navigating the complexities of business transition requires skilled guidance. A Certified Exit Planning Advisor (CEPA), who is ideally a CPA and CFP®, will bring invaluable support throughout the process. With a deep understanding of financial landscapes and business transitions, a CEPA can help you make informed decisions and achieve your exit goals.

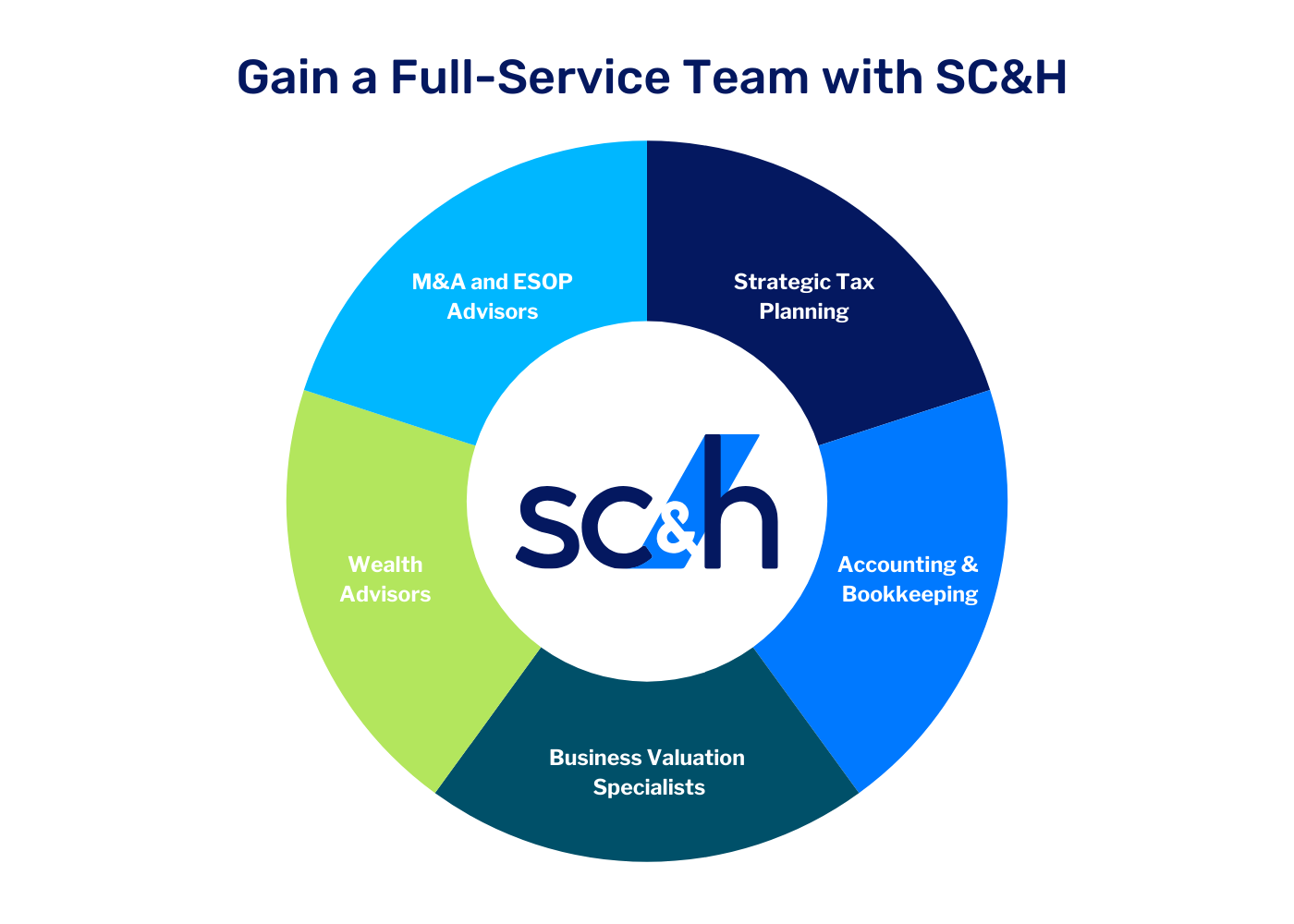

Plus, CEPAs have access to a network of industry professionals who can assist with every aspect of your exit plan.

Proactively Plan Your Exit Strategy with Precision

Exit planning is more than just selling your business. It’s about securing your financial future while preserving your legacy. Navigating the complexities of valuation, tax implications, and market conditions can be overwhelming. Let us guide you through this critical phase. Our professionals are ready to help you maximize the value of your business, minimize tax liabilities, and create a seamless transition into your life beyond business ownership. Contact us today to start the conversation.

Advisory services offered through SC&H Wealth, the doing business as name of SC&H Financial Advisors, Inc. SC&H also offers advisory services through the doing business as name of SC&H Core. SC&H Financial Advisors, Inc. is a wholly owned subsidiary of SC&H, Inc.

These materials have been prepared by SC&H Wealth for informational purposes and does not constitute or form part of, and should not be construed as, an offer to sell or issue, a solicitation of any offer to buy, or a recommendation with respect to, any securities and should not be relied upon as investment advice. The views expressed are subject to change. Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. Past performance is no guarantee of future results.

Any third-party links, trademarks, service marks, logos, and trade names included in the report are property of their respective owners. The inclusion of third-party link is provided for reference and does not imply endorsement or, or association with, the site or party by us. This communication serves to provide certain opinions on current market conditions and is not a recommendation to engage in, or refrain from engaging, in a particular course of action.

This communication is not intended to provide tax, legal, insurance or other professional advice. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. Any action taken based on information in this communication should be taken only after a detailed review of the specific facts, circumstances of your individual situation and current law. Please contact your advisor for further guidance.