There are important distinctions between independent contractors and employees that influence pay, taxes, and benefits—and knowing the difference could save you a lot of time and money. According to Justworks, the DOL and the IRS estimate that up to 3.4 million workers are classified as independent contractors when they should be reported as employees. If it is determined that a worker was intentionally misclassified as an independent contractor, the employer could face penalties that include 20% of the wages paid, plus 100% of the FICA taxes—both the employee’s and the employer’s share. Criminal penalties of up to $1,000 per misclassified worker and one year in prison can also be imposed.

Independent contractor misclassification occurs in a wide range of workplaces, both blue and white collar. It tends to be disproportionately high in industries where it is most profitable like, but not limited to, construction, on-demand startups, real estate, cleaning and janitorial services, in-home care, and trucking. The scale of the issues may require solutions that extend far beyond individual worker complaints, so let’s focus on prevention as the best course of action.

4 Sound Tactics for Determining Independent Contractor Status vs Employee Status

#1: The Basics

Let’s explore a few notable worker status distinctions to keep you in the safe zone:

- Pay: Only employees are protected by the Department of Labor’s wage and hour law, the Fair Labor Standards Act, and similar legislation. This act sets rules for minimum wages, overtime, child labor, OSHA, workers’ compensation insurance and other protections.

- Taxes: Employers must withhold payroll taxes from employee pay, but you do not withhold taxes from payments to independent contractors

- Benefits: Employees may be eligible for certain fringe benefits as well as retirement plans, while independent contractors are not.

#2: General Criteria

Below is a list of general criteria to apply when deciphering the employment status of a worker. If all statements are true, then the worker can be assumed to be an independent contractor:

- Worker supplies his or her own equipment, materials, and tools

- All necessary materials are not supplied by the employer

- Worker can be discharged at any time and can choose whether to come to work without fear of losing employment

- Worker controls the hours of employment

- Whether the work is temporary or/and non-integral

#3: Common Law Test

Additionally, the Common Law Test is used by the IRS to determine if a worker should be classified as an employee or an independent contractor. For the purpose of this piece, we’re focusing on the criteria for the latter. The test is driven by a set of rules that considers all information providing evidence of the degree of control and independence between an employer and worker, looking specifically at three categories:

- Behavioral Control

This explores the level of control an employer does or does not have over the work being performed by the worker:- Worker does not receive specific instructions such as when and where to work, what tools to use or where to purchase supplies and services

- Worker receives less detailed instructions which reflects less control by employer

- Worker is not subject to periodic evaluation systems to gauge quality of work

- Worker does not receive periodic or on-going training about procedures and methods

- Financial Control

This points to whether or not the employer has the right to control economic facets of a worker’s job:- Worker does not receive significant investment in the equipment and other tools the worker utilizes

- Worker is more likely to incur unreimbursed expenses

- Worker will have an opportunity for profit or loss

- Worker is free to work for multiple persons/organizations

- Relationship Type

This is based on the shared perception between the employer and worker:- Worker will not be eligible for employee-type benefits, such as insurance, a pension plan, vacation or sick pay, paid time off, etc.

- Relationship will be for a specific project or period, no expectation that it will continue indefinitely

- Worker performs services that may not be a key aspect of the regular business of the company

#4: DOL’s Final Law

On January 6, 2021 the final rule for clarifying the standard for employee versus independent contractor is set by the U.S. Department of Labor (DOL) under the Fair Labor Standards Act (FLSA). Listed below are the components of the final rule:

- Reaffirms an “economic reality” test to determine whether an individual is in business for him or herself (independent contractor) or is economically dependent on a potential employer for work (FLSA employee).

- Identifies and explains two “core factors” that are most probative to the question of whether a worker is economically dependent on someone else’s business or is in business for him or herself:

- The nature and degree of control over the work

- The worker’s opportunity for profit or loss based on initiative and/or investment

- Identifies three other factors that may serve as additional guideposts in the analysis, particularly when the two core factors do not point to the same classification:

- The amount of skill required for the work

- The degree of permanence of the working relationship between the worker and the potential employer

- Whether the work is part of an integrated unit of production

- The actual practice of the worker and the potential employer is more relevant than what may be contractually or theoretically possible.

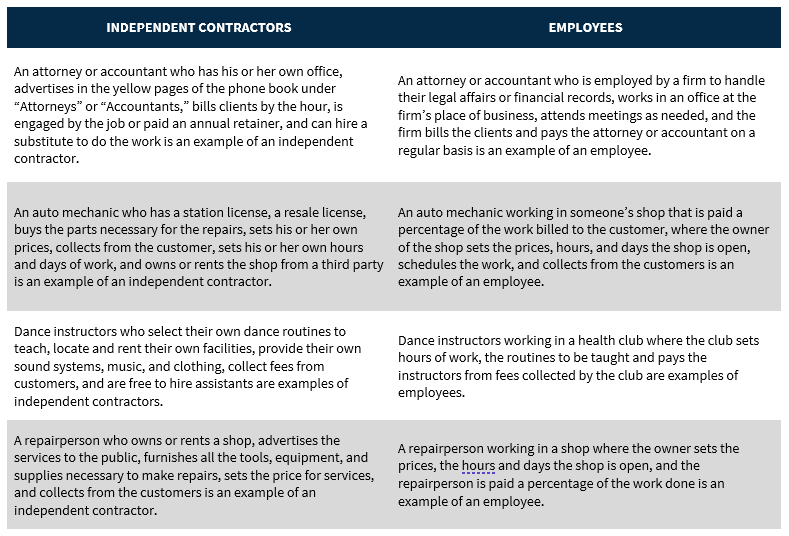

Independent Contractor vs Employee Examples:

Due to the short– and long-term positive impact on a business’s bottom line and a reduction in administrative burdens, there’s an increase in employers applying the independent contractor status. However, employers must exercise caution when making this determination to avoid the legal and financial ramifications associated with misclassified employment status. Several states, California being the most notable, are looking to convert independent contractor treatment to employee treatment across a broad swath of situations.

If you are still uncertain of the proper classification, here are your next steps:

- Explore additional resources to build your understanding, these are two great options from the IRS:

- Keep records and a paper trail as proof that appropriate steps were taken to comply with the DOL guidelines.

Most critically, consult the proper accounting and legal professionals to help gain necessary clarity. This is where SC&H can help. If you’re looking for further guidance, please reach out to us today.