Not-for-profit organizations–education, healthcare, human services, and NGOs–face unique accounting challenges. But one thing they all have in common is needing a highly personalized solution for reporting and grant accounting.

Sage Intacct is our top recommendation for nonprofit clients because it makes life easier for these organizations’ small but mighty financial teams.

We believe it’s the best solution because:

- It’s cloud-based and accessible for employees anytime, anywhere

- It consolidates all the nonprofit’s critical data into one dashboard

- It can provide deeper-level insights with robust reporting

- It’s user-friendly with a clean interface

If your organization isn’t using Sage Intacct, we’ve rounded up the top five features you’re missing out on. Keep reading to discover why Sage Intacct is the must-have accounting solution for your nonprofit.

#1 Comprehensive Fund Accounting

Fund accounting is difficult, but it’s even more challenging if your accounting software isn’t specifically set up for it. One of the top reasons you’ll love Sage Intacct is because it boasts the ability to easily manage fund accounting.

For example, you can:

- Record revenues to specific funds and grants

- Specify and relieve restrictions

- Record time and expenses for grants

- Easily create invoices

Of course, each grant comes with the expectation that your nonprofit will use it to make a positive impact on your mission. Proving that result for multiple grants has never been easier with Sage Intacct’s reporting.

You can include details unique to your program’s delivery with easy configuration, then search and report on those details, financial data, and impact metrics for each grant.

#2 Smooth Compliance Reporting

Compliance reporting is time-consuming, painful, and crucial for nonprofits. Instead of trying to stitch together reports in Excel, streamline compliance reporting with Sage Intacct.

With the financial report writer, you can quickly produce complex reports without the headache of an outdated manual system.

These are just a few examples of reports organizations can quickly create, but Sage Intacct can configure many others within its system:

- Statement of Activities

- Statement of Financial Position

- Statement of Cash Flow

- Statement of Functional Expenditures

- Form 990

#3 Personalized Key Performance Indicators (KPI)

Many nonprofits struggle to create and analyze KPIs because the process of compiling data from multiple sources is so complex and time-consuming. A modern solution like Sage Intacct gives your organization the ability to set up personalized KPIs and make decisions based on key metrics.

You can create individualized metrics that are important to your cause, such as:

- Program efficiency

- Revenue per member

- Fundraising efficiency

- Average donation size

- Number of donors

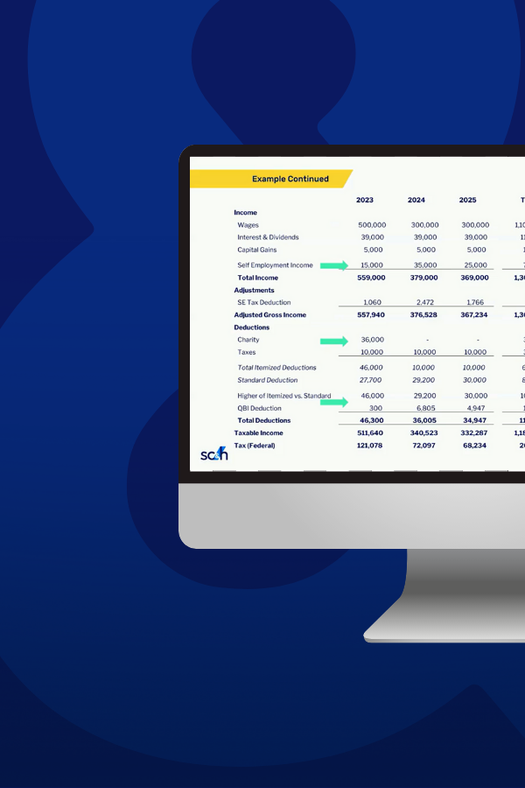

#4 Simplified Multi-Entity and Multi-Dimensional Solutions

Managing different entities and locations in multiple systems is an inefficient and frustrating method for accounting teams. This is why so many nonprofits have switched to Sage Intacct, where they can combine all their data for a simpler and more accurate solution.

Sage Intacct allows you to have multiple entities, meaning you can manage each location and department in one system. Bonus for nonprofits: in addition to the eight out-of-the-box dimensions, nonprofits receive three (free!) additional user-defined dimensions so you can easily track what’s most meaningful.

Since your accounting team won’t have to spend hours extracting and consolidating data from several sources, they can quickly produce multidimensional reports. These reports can even include a mixture of some entities consolidating and others not consolidating. Examples include:

- Program Revenue and Expenditures

- Donor based reports

- Fundraising campaigns

- Grant management reports

#5 Strong Internal Controls

Many organizations struggle to set up useful internal controls. Sage Intacct centralizes these controls so administrators can easily adjust as needed.

There are many ways you can set up internal controls:

- Create view and write users

- Provision roles (e.g. payroll clerk, biller, admin, controller, CFO) and only allow access to specific parts of the system

- Assign roles to employees

- Assign user groups to reports

- Provide board members with necessary dashboards and reports

- Import budgets and utilize a budget to actual report

With these personalized control options, your nonprofit can feel secure that its data is protected and confident that employees and board members can directly access the data they need.

Switch to Sage Intacct

An easy-to-use accounting system helps organizations reach their goals and fulfill their mission. If you want to gain deeper insights and make a bigger impact on your mission, schedule a free 1:1 Sage Intacct Demonstration with our team.

Our expert accounting team can guide you through solutions to your current challenges!