The 2024 Guide to Contract Compliance Audits

How contract compliance audits help Chief Procurement Officers (CPOs) reduce costs, mitigate risks, and identify untapped savings.

Table of Contents

What is a Contract Compliance Audit?

A contract compliance audit is a systematic review conducted to ensure that parties are adhering to the terms outlined in a contract.

The scope includes reviewing various aspects such as financial records, operational processes, documentation, and performance metrics to verify compliance. These audits are typically conducted by a third-party auditing firm to ensure objective results.

Why Your Business Needs a Contract Compliance Audit

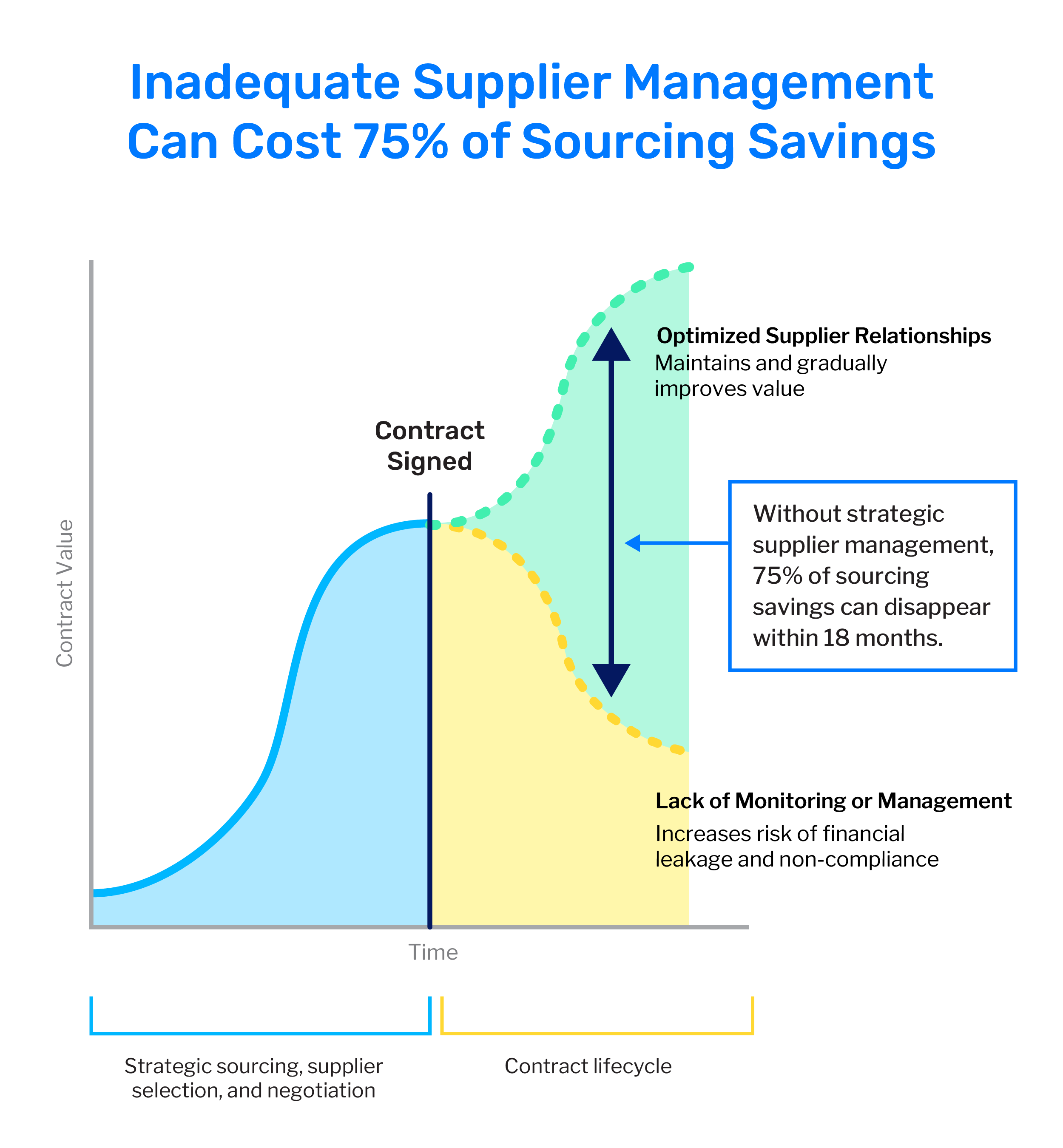

Prevent Contract Value Erosion

The average value erosion of a contract after signing is more than 8.6%. For large organizations, that adds up to millions in lost profits quickly. A contract compliance audit can stop margin erosion in its tracks and ensure you’re getting maximum value from your contracts.

After putting hours of time and energy into negotiating the perfect contract, maintaining oversight after signing can be challenging. But that means value erosion and potential risks easily go unnoticed–and minor discrepancies can snowball quickly if audits aren’t performed regularly. Engaging a third-party team of experts to audit your contracts is critical to maintaining oversight without overextending your team.

Common Causes of Contract Value Erosion

Projects that take longer and cost more than expected can quickly erode the value of the contract.

Overbillings are easily overlooked without a process in place to look for them. Procurement is often left out of the billing workflow, so they can’t see where the errors begin. And many invoice approvers lack the more detailed information they need from suppliers, as well as time or resources to check for mistakes.

You and your supplier may interpret costs differently as a result of ambiguous language or a lack of transparency.

42% of procurement teams say that there is no clear responsibility for oversight of contract management. Without this structure, everyone assumes someone else is responsible, and mistakes go undetected.

External factors like market fluctuations and M&A activity cause unpredictable cost spikes, unreliable supply chains, and organizational disruptions. While many of these events are unforeseeable, a well-written contract and effective monitoring can reduce their potential impact.

Identify Errors & Ensure Contracts are Upheld

If you think contracts are confusing, you’re not alone. 90% of business professionals find contracts “impossible to understand.” That’s because contract language isn’t designed for readability—most language is written with litigation in mind. This creates massive opportunities for mistakes and miscommunications with suppliers.

A contract compliance audit can help ensure all parties meet their obligations. Experienced auditors live and breathe this language, decoding your contracts and identifying errors in record speed.

And contrary to what you might think, third-party audits won’t eat up all your time. An audit with SC&H requires, on average, only 12 hours total of stakeholder support per engagement.

This is a relief for procurement teams facing resource constraints—CPOs listed operational workload as their #1 barrier to progress in 2023. Enjoy the cost savings while reclaiming your time freedom.

4 Benefits of Contract Compliance Audits

BENEFIT #1

Recover Millions in Lost Profits

A contract compliance audit can uncover critical errors and discrepancies in your contracts that lead to significant cost recoveries. Auditors will pinpoint the root issue quickly, negotiate with suppliers, and facilitate timely resolutions that generate maximum ROI for your business.

SC&H’s contract compliance audit team typically recovers 2-4% of the transaction value audited. Cash recoveries can quickly add up for large, multi-year contracts, returning millions back to the organization. Performing regular contract compliance audits also establishes long-term process improvements, ensuring that every dollar spent aligns with negotiated agreements and maximizes value.

Recommended Reading: How to Unlock Savings in Procurement Without Increasing Risk

Common Sources of Lost Savings

- Over-billed rates, unit prices, or taxes

- Excess mark-ups and margins

- Overstated costs

- Unrealized media credits

- Verbal and non-binding agreements

- Underpaid rebates and incentives

- Failure to pass through discounts

- Noncompliance with T&E policies

- Related party transactions

- Noncompliant subcontracting

- End-of-fiscal period prepayments

- Understated sales or underpaid royalties

BENEFIT #2

Improve Supplier Relationships

Contrary to popular belief, contract compliance audits can improve supplier relationships and increase trust by providing a structured system that encourages open communication and reduces conflict. When performed properly, they can restore confidence to ailing relationships to unlock value for both parties.

Top-performing procurement teams that prioritize supplier relationships enjoy 35% more collaboration and 58% higher supply chain visibility than their peers. However, cost savings can disappear quickly when supplier relationships aren’t properly managed and optimized. Contract compliance audits can offer valuable insights to identify mutually beneficial strategies and achieve shared objectives.

Recommended Reading: 4 Procurement Strategies to Fight Inflation and Mitigate Contract Risks in 2023

BENEFIT #3

Increase Efficiency & Do More With Less

With 74% of CPOs noting operational efficiency as their top priority—and operational workload as their #1 barrier—contract compliance audits are a valuable tool for boosting productivity. Audits uncover where contracts, processes, and controls are out of sync or underperforming. CPOs can then use the audit findings to improve organizational harmony and standardize processes.

Unsurprisingly, streamlining for productivity directly correlates to better business outcomes. High-performing procurement teams deploy standardization strategies 20% more than low-performing teams, leveraging third-party solutions (rather than trying to perform audits internally) nearly twice as often as their peers to mitigate resource constraints. Third-party auditors can also speed up resolutions with suppliers, navigating negotiations with ease while your team stays focused on the business.

Examples of How Audit Findings Can Be Leveraged

| Audit Finding | Action Taken |

|---|---|

| Contract renewals are delayed due to manual tracking and lack of centralized oversight. | Implement a contract management system with automated renewal reminders to centralize the renewal process and reduce disruptions |

| Multiple departments engage similar suppliers independently, leading to redundant contracts and missed volume discounts. | Consolidate contracts through strategic sourcing initiatives, streamline enterprise-wide supplier management, and negotiate bulk discounts to cut costs. |

| Procurement processes heavily rely on manual and paper-based methods, causing delays and errors. | Invest in a digital procurement platform that automates approval workflows and uses AI tools to reduce processing times and minimize errors. |

BENEFIT #4

Mitigate Third-party Risks

Monitoring supplier risk can be extremely complex and challenging, requiring both people and technology to monitor properly. Contract compliance audits provide a structured, streamlined process to assess and monitor the performance of third-party partners against contractual obligations.

Signs You’re at Risk of Third-Party Non-Compliance

Contracts with multiple entities, large multi-year projects, data privacy concerns, or complicated pricing structures are examples of complex terms that can increase risk. An audit can ensure compliance with terms and effective operating procedures.

If your third party is not meeting operational objectives such as KPIs and SLAs, pricing compliance may also be lacking. An audit can help identify root causes of the operational challenges and contribute to improved operations.

Small, private companies tend to lack the internal controls to maintain compliance, especially when experiencing rapid revenue growth. An audit can reduce risk and help the third party understand the value of investing in controls.

Business leaders noted data privacy as their top concern for third-party risk management. Security breaches are on the rise nationwide, with 41% of surveyed companies reporting an impactful third-party breach in the past 12 months (up 20% from 2021).

It’s a valid concern—a single non-compliance incident costs over $14 million on average, and the average fine for GDPR violations starts at 2-4% of a company’s annual revenue. Periodic contract compliance audits can help you identify gaps in your contracts that expose third-party risk and optimize contract terms accordingly.

Recommended Reading: How to Ensure Supplier Compliance with Data Protection and Data Privacy Laws 2023

How the Audit Process Works

A contract compliance audit may seem intimidating, but SC&H’s experienced, certified auditors have broken it down into four simple steps. We work as an extension of your team to complete audits with suppliers without disrupting operations.

Contract Compliance Audit FAQs

A contract compliance audit is a systematic review conducted to ensure that parties are adhering to the terms and conditions outlined in a contract. The scope includes reviewing various aspects such as financial records, operational processes, documentation, and performance metrics to verify compliance. These audits are typically conducted by an independent third-party auditing firm to ensure objective results.

Contract compliance audits should ideally be performed annually or biannually depending on the complexity of your organization’s contracts. Non-compliance can snowball into costly mistakes quickly, so conducting proactive audits on a regular cadence addresses issues promptly and reduces the risk of unpleasant surprises.

The duration of an audit varies depending on how many contracts are reviewed, the organization’s size, and the availability of relevant documentation. A contract compliance audit can take anywhere from several weeks to a few months to complete thoroughly. At SC&H, you can typically expect recoveries in as little as 30-60 days.

The auditor may recommend corrective actions to bring the parties back into compliance. Depending on the severity of the non-compliance, this could involve renegotiating the contract terms, imposing penalties, or even legal action.

Responsibility for contract compliance typically falls on multiple parties, including:

- Contract Managers: Responsible for overseeing the execution and performance of contracts, ensuring compliance with terms and conditions.

- Procurement Teams: Involved in negotiating and drafting contracts, as well as monitoring supplier/vendor compliance.

- Legal Department: Provides guidance on contractual matters and ensures contracts adhere to legal requirements and regulations.

- Finance Department: Oversees financial aspects of contracts, such as invoicing, payments, and financial reporting.

- Operational Teams: Responsible for fulfilling contractual obligations related to delivering goods or services as outlined in the contract.

Best practices include maintaining accurate and up-to-date contract documentation, establishing clear processes for contract management, training staff on contract obligations, and proactively identifying and addressing compliance issues.

- After significant organizational changes: Conducting audits after mergers, acquisitions, or restructuring ensures alignment with the new organizational structure and goals.

- Periodically throughout the contract lifetime: Implementing audits at scheduled intervals, such as biannually, can help identify any deviations or issues over time.

- Upon contract renewal or extension: The best time to correct misunderstandings or gaps is before the new contract is finalized. This presents an ideal opportunity to assess the existing terms, ensure compliance, and make any necessary adjustments for the new contract. The best time to correct misunderstandings or gaps is before the new contract is finalized.

- When a third party presents a key risk factor: Operational challenges, disclosures of past errors, whistleblower reports, data breaches, adverse news reports, and other such factors can indicate an urgent need for an audit.

- During supplier transitions: When transitioning between suppliers and terminating contracts, an audit can ensure a smooth handover and verify compliance with contractual obligations.

Choosing the Right Third-Party Auditor

Most organizations do not have the capacity, expertise, or technology to conduct regular contract compliance audits in-house. Hiring an independent specialist frees up your internal resources and reduces the impact on organizational workload.

When selecting an audit partner for your team, we recommend the following criteria:

Specializes in contract compliance audits

This process requires highly specialized knowledge and experience. Engaging professionals focused exclusively on contract compliance audits allows them to produce maximum ROI.

Holds key certifications and qualifications

Verify that the auditor team is comprised of Certified Public Accountants (CPAs), Certified Internal Auditors (CIAs), and Certified Fraud Examiners (CFEs).

Leverages both technology and people

Assess the firm’s use of technology for efficient data analysis and the intuition and experience of its skilled auditors to ensure they can handle the volume and complexity of your company’s contracts.

Prioritizes transparent communication

Choose an auditor that communicates transparent processes and methodologies, allowing your internal stakeholders and supplier stakeholders to understand the audit approach and timeline.

SC&H’s contract compliance audit team checks all these boxes and more. We offer more than three decades of industry experience implementing, designing, and executing effective third-party contract compliance audit programs for Fortune 1 to Fortune 500 companies in over 25 countries. Learn more about how contract compliance audits can help you meet your goals with a no-obligation assessment from the SC&H team.

Common Types of Contract Compliance Audits

Direct & Indirect Spend Audits

Recover overpayments while strengthening your supplier relationships. Our team works to identify inadvertent errors, facilitate timely resolution, enhance processes, and improve contract language without disrupting operations.

LEARN MOREThird Party Risk Management

Protect your bottom line while increasing value and transparency in your third-party relationships. We analyze your business’s financial, operational, cyber, and legal risks to build a tailored third-party risk management program.

LEARN MOREContract Management

Tired of negotiating the perfect contract then struggling to maintain oversight a few months later? We can fill the gaps. From writing stronger contracts to improving invoice review processes, our team supports every stage of the contract lifecycle to help you detect and prevent overpayments and non-compliance.

LEARN MOREAccounts Payable & Recovery Audits

Accounting mistakes happen. We’ll help you fix them and ensure they don’t happen again. Resolve unrealized credits, recover residual funds, and bolster financial performance with a thorough, data-driven examination of supplier records.

LEARN MOREConstruction & Capital Expenditure Audits

Maximize ROI on your biggest construction projects (and biggest investments) while ensuring transparency with your contractors. Our auditors pinpoint, recover, and prevent financial losses so you can stay focused on project completion.

LEARN MORERoyalty and Licensing Audits

Stop unrealized, miscalculated, or untimely royalty payments in their tracks to restore the health of your margins and revenues. We work to validate compliance across your negotiated contracts while also strengthening internal controls, contract language, and licensee relationships.

Forensic Data Analysis and Data Mining

Expose potential fraud or waste in your data quickly and accurately to reduce risk and improve business performance. We pinpoint irregularities and anomalies in data sets up to 100 million records (or more) using AI-powered technology and drawing on 30+ years of experience working with major ERP systems.

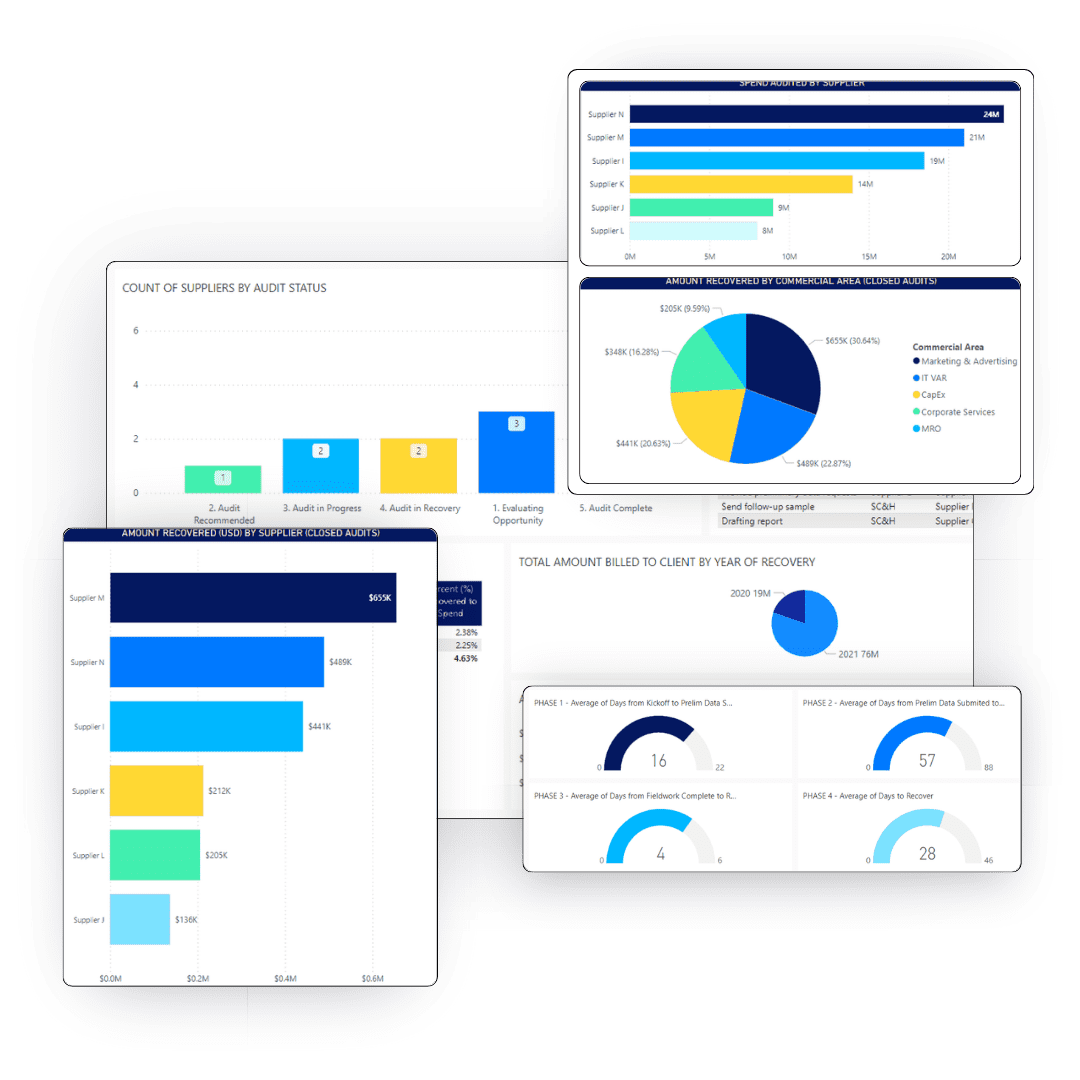

Technology & AI in Contract Compliance Audits

Auditors leverage powerful data analytics tools to facilitate effective monitoring, identify patterns of non-compliance, and support the timely resolution of issues. Over the past three decades, SC&H has developed proprietary algorithms to identify anomalies that warrant further scrutiny efficiently.

Additionally, the SC&H team uses Power BI to create on-demand reporting portals that help visualize recurring problems within their clients’ contracts.

While technology can aid in the effectiveness of contract compliance audits, it does not replace an auditor’s intuition, judgment, and experience. Tools like AI and machine learning can still give way to errors and mistakes in contracts and third-party relationships. The best auditors leverage both people and technology to perform validation quickly and comprehensively.

This is why many organizations are turning to an external audit partner to help with compliance, risk mitigation, and risk corrections before mistakes can happen at scale.

Recommending Reading: How to Align Technology and People to Mitigate Contract Risk and Ensure Compliance

Busting Contract Compliance Audit Myths

No. Contrary to popular belief, contract compliance audits build stronger relationships. Restoring transparency and earned trust enables a more collaborative, mutually beneficial relationship. Insights garnered from the audit can be applied to future business between the parties to generate additional value and achieve desired outcomes.

When performed by an experienced auditor, the daily operations of the third party are minimally disruptive. The auditors create and communicate a clear timeline to ensure smooth execution and limit the involvement of key operational personnel, leveraging support from the third party’s back-office finance department instead.

No. An experienced auditor will generally require less than five hours of stakeholder support per audit—a time investment more than offset by the potential for cost savings and process improvement. This typically includes:

- A stakeholder conversation to review and sign off on audit specifications before work begins

- Updates provided during the audit process

- A discussion of results once the audit is complete

Additional support is required only on rare occasions.

Not necessarily. While a well-crafted audit clause guarantees access to third-party data and records, your ongoing relationship is usually sufficient to conduct an audit. Third parties typically cooperate with an audit request, as they recognize that it allows both parties to improve processes.

No. Most invoice and payment errors are caused by a misunderstanding of intricate contract terms, an unintentional oversight in manual billing processes, or programming glitches. Nonetheless, they are common and costly. An experienced auditor can pinpoint errors and their possible causes and then recommend internal control enhancements to reduce them in the future.

Since most billing errors are unintentional, legal or unilateral actions are rare. The most common resolution is a negotiated settlement, which is mutually agreed upon by both parties. This ultimately strengthens the third-party relationship with process improvements and contract clarifications that ensure future alignment and compliance.

Why Work With SC&H

Choose SC&H as your third-party contract compliance auditor for swift, transparent audits that can recover millions in overspending in as little as 30 days after audits are initiated. Our professionals bring more than 30 years of industry experience executing effective contract compliance audit programs for Fortune 1 to Fortune 500 companies in over 25 countries. We’re adept at navigating the intricate landscape of contract negotiations, ensuring resolutions faster than our competitors, and preventing future margin erosion. With an in-house team of Certified Public Accountants, Certified Internal Auditors, and Certified Fraud Examiners, we deliver immediate ROI and long-term cost savings through a contract compliance audit that pays for itself.